Cross-Convolutional Neural Networks applied to Finance

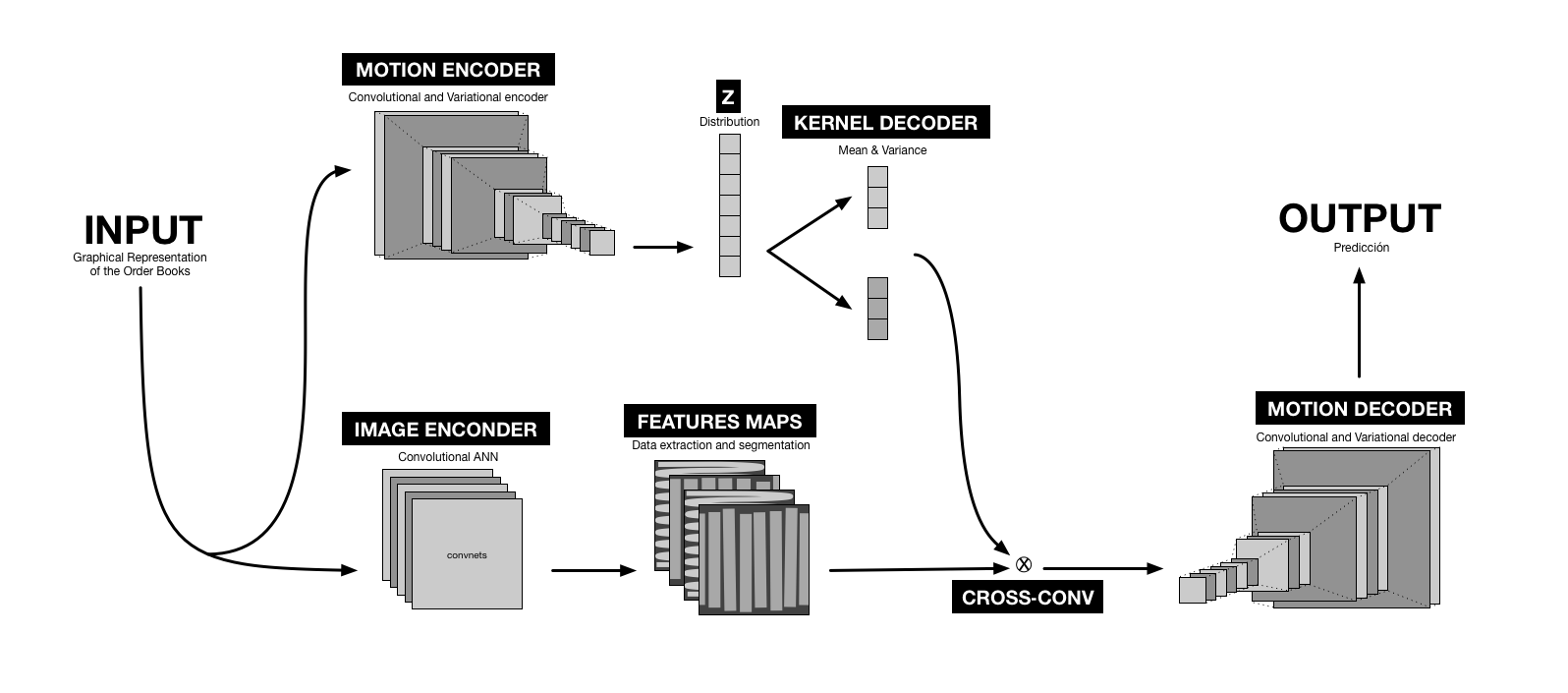

This project was part of the search carried on in the Algorithmic and Combinatorial Research Group. The main idea was to apply a model for Short-term Stochastic Motion Prediction to the Stock Market (based on this paper). The model predicted the possible movements given only one static frame using two sub-models, a motion and an image encoder, the first one takes care of encoding the motion information, the later decodes the images in smaller static parts from which the original object is build again. Followed by their proposed network structure, called Cross Convolutional Networks.

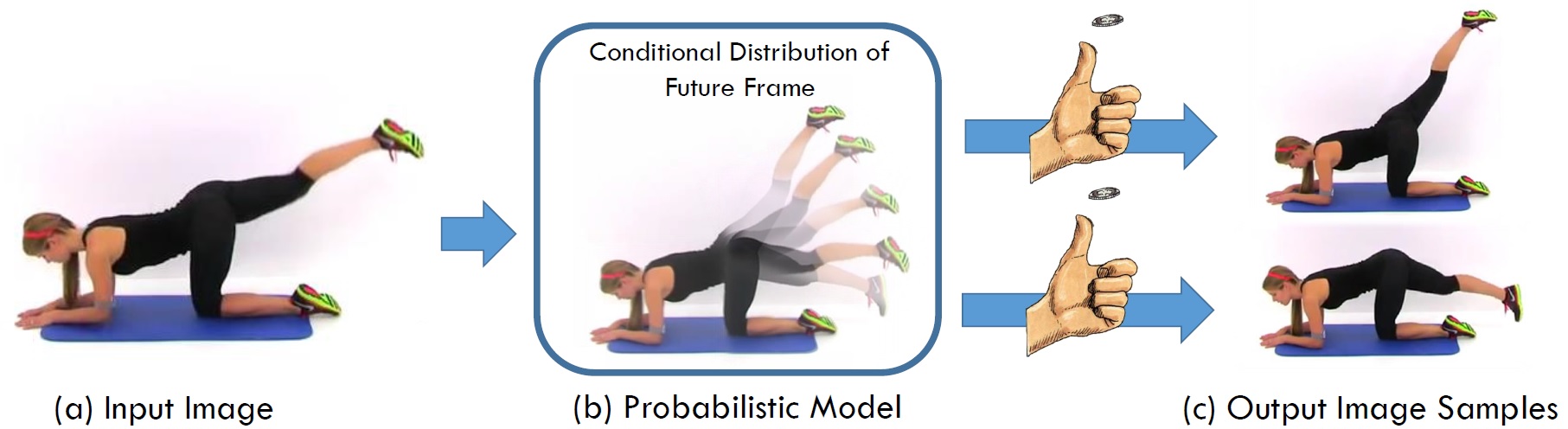

For example, in the image above, the next movement of the girl in the left can be moving the leg up or down. This architecture is able to model those small movements stochastically. The main objective was to adapt the model to a dataset of orders from any stock (that is all the negotiating orders while the markets are open, even if the order was not executed and remained opened) to be able to model the movements in the stock price.

The model used a combination between convnets and autoencoders to understand and decode the image in different elements and predict the “logical” movement of each element. Then, using the single elements decoded from the image, reconstruct the new image with the movement already applied, somewhat similar to a capsule net.

The original model used images in which the movement was easy to predict, like characters in a 2D world or fitness videos. The hypothesis was that the order books for any stock shared certain important abstract elements which allowed this kind of model to extract useful patterns to predict the future behaviour of the stock being analysed.

* First figure was taken from Visual Dynamics: Stochastic Future Generation via Layered Cross Convolutional Networks.